Lake Water Advisory provides disciplined investment management for high-earning professionals who want their portfolios managed with academic rigor and fiduciary care.

At the core of our investment approach is a steadfast commitment to evidence-based strategies grounded in decades of academic research. We do not chase trends, time markets, or rely on speculation. Instead, we draw upon Nobel Prize-winning research and peer-reviewed studies that demonstrate the long-term value of disciplined portfolio construction, broad diversification, and cost efficiency.

Our process is rooted in reason, not reaction — aiming to capture market returns in a structured, tax-aware, and risk-appropriate manner.

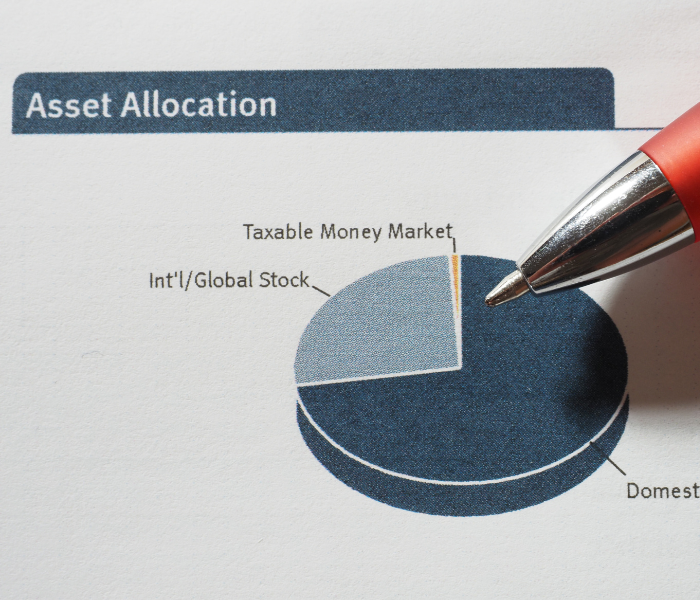

Every portfolio we design begins with a deep understanding of each client's unique financial situation, goals, and risk tolerance. From there, we employ a global asset allocation framework that emphasizes broad market exposure, systematic rebalancing, and the smart use of low-cost, tax-efficient investment vehicles.

We don't try to outsmart the market. We build portfolios designed to capture market returns while managing risk and taxes efficiently.

We serve as fiduciaries, meaning your interests come first — always. That commitment shapes every decision we make, including our refusal to be swayed by market noise, headlines, or unproven trends.

Our role is to provide clarity, discipline, and stewardship, helping clients stay focused on what they can control while navigating the inevitable ups and downs of the market. We believe that true investment success is not about finding the next big idea, but about consistently applying a proven strategy over time.